|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

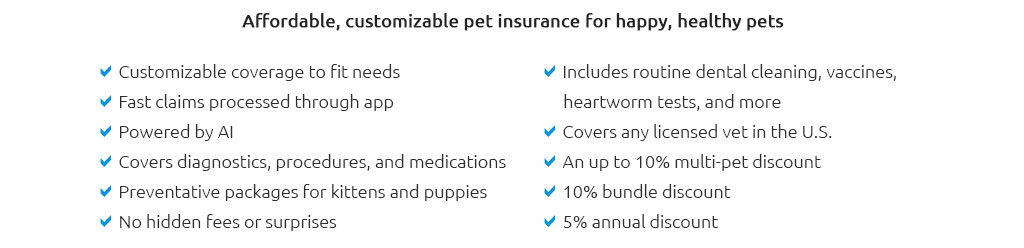

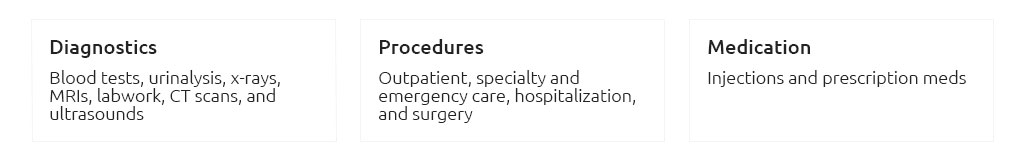

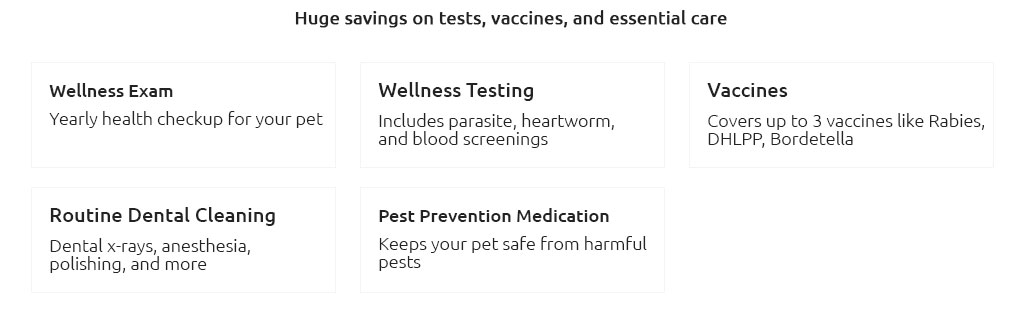

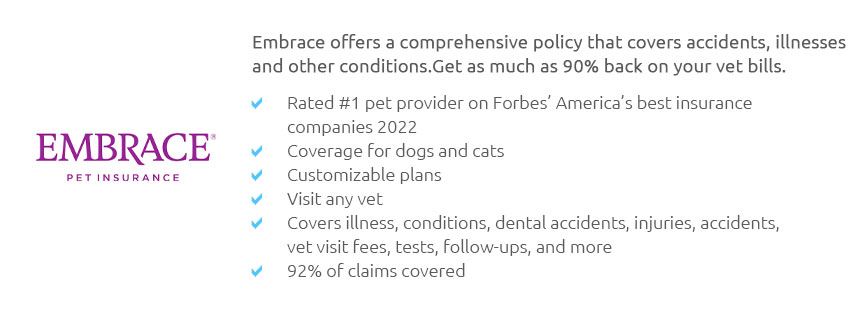

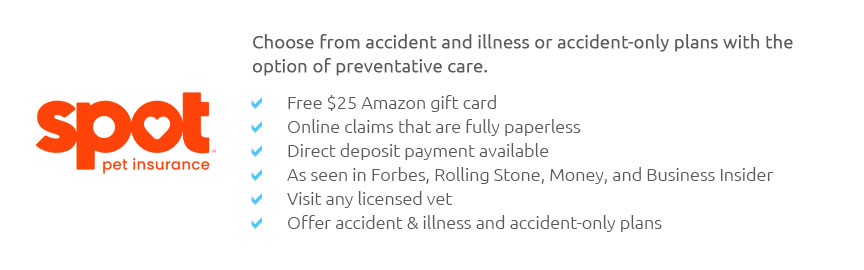

Comparing Pet Insurance: Navigating Your OptionsWhen it comes to ensuring the health and well-being of our beloved pets, pet insurance has become an increasingly popular option for many owners. The peace of mind it offers-knowing that unexpected veterinary costs won't wreak havoc on your finances-is indeed invaluable. However, the process of comparing pet insurance policies can be overwhelming due to the sheer number of providers and plans available today. Before diving into specific policies, it’s crucial to understand what pet insurance typically covers. Generally, most plans offer coverage for accidents and illnesses, but beyond this, the details can vary significantly. Some providers include wellness care-such as vaccinations and routine check-ups-while others may exclude these from their standard policies, offering them as add-ons instead. One of the first steps in comparing pet insurance is to identify your specific needs and those of your pet. For instance, a young, healthy cat may require different coverage compared to an older dog with pre-existing conditions. It's essential to assess factors such as your pet’s breed, age, and any existing health issues, as these can affect both the cost and coverage options available to you. Many pet owners make the mistake of solely focusing on the monthly premium. While affordability is important, it's also vital to consider the policy’s deductibles, co-pays, and the annual or per-incident limits. A plan with a lower premium might have higher out-of-pocket costs when you need to file a claim, which can be a significant drawback in the long run. Moreover, different insurers have varying reputations when it comes to customer service and claims processing. Reading reviews and seeking recommendations from other pet owners can provide valuable insights into the real-world experiences of dealing with these companies. For example, a provider known for denying claims or delaying payments might not be worth the initial savings on premiums.

Ultimately, the best pet insurance policy for you will depend on balancing the cost with the coverage and services that best meet your needs. It’s advisable to obtain quotes from multiple providers and carefully read the policy details, including any exclusions or limitations. Remember, the cheapest plan isn't always the best choice if it leaves you uncovered for essential treatments or results in high unexpected expenses. In conclusion, while the task of comparing pet insurance may seem daunting, taking the time to thoroughly research and evaluate your options will pay off in ensuring both your peace of mind and the health of your pet. With careful consideration, you can find a policy that provides comprehensive coverage at a price that fits your budget, allowing you to focus on what truly matters: the joy and companionship your pet brings to your life. https://www.confused.com/pet-insurance

Compare cheap pet insurance quotes from 5.19. Get a pet quote. Our expert panel reviews all content. Learn more about our editorial standards. https://www.gocompare.com/pet-insurance/dog-insurance/

For all dog pet insurance quotes, 10% received a price of 3.95 per month or less. Data taken from March to May 2024. https://www.moneysupermarket.com/pet-insurance/dog-insurance/

Compare Dog insurance for less than at 9.74/month. Cover unexpected vet costs, injuries, illnesses, and more. Find comprehensive plans for your dog today!

|